Annie Harper and Bridgett Williamson work on financial health.

Financial Health

Financial Health

Resources, one of the “Five R’s” of citizenship, are an essential component of a complete life in the community. Money—while not the only resource a person may possess—is a critical resource that most people need in order to survive.

Yet many adults with mental health challenges live in extreme poverty and struggle to make the most of whatever meager funds they have.

Currently, the only support available to people using mental health services who find themselves unable to manage financially is to be assigned a “representative payee,” or conservator, who takes control of their money and pays bills on their behalf.

While removing control of someone’s finances from them may be extremely helpful in some cases, it can hinder the recovery process and is certainly not the answer for everyone living with a combination of mental health and money problems.

What we do

We aim to identify and support effective ways to promote financial health among people receiving mental health services. Our goals are to help people in recovery:

- Have more secure and effective incomes

- Reduce debt and build assets

- Experience less finance-related stress

- Remain in control of their own finances, if they wish to do so

- Achieve financial independence in terms they define

Past/Current Activities and Research

Financial capability and mental health:

We conduct research how to help people with mental health challenges who control their own funds do better with their money. Building on this research we have created financial health modules integrated into existing programs, such as the CMHC Better Eaters Club, and the PRCH Citizen’s Project. We also provide Your Money Your Goals training to mental health agency staff and other social service providers to help them integrate financial capability support into their work. We are working closely with the New Haven Financial Empowerment project to ensure that programs they offer, such as free financial counseling and promotion of safe, affordable BankOn accounts, are inclusive of people with mental illness.

Supported financial decision making:

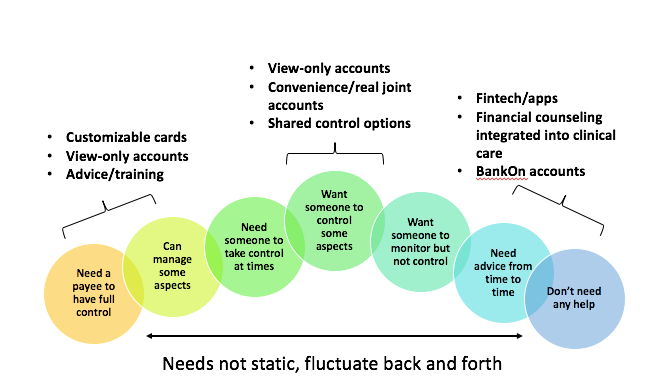

We are also conducting research into how we can help people with mental health challenges who may have very different types of support needs when it comes to their finances, which may change at different times of their lives. In particular we are interested in how financial technology can be helpful with this.

Debt, recovery and well-being:

Many of the financial difficulties that people with mental health challenges face are the same as anyone who lives in poverty, including being more likely to be burdened by debt that they cannot afford to repay. We are conducting research to understand better how debt affects people’s recovery and wellbeing, including people with histories of incarceration.

For more on our research, click here.